How do you get started Living frugally?

4 ways to live more frugally.

With the way of the world at the moment, more people than ever before are looking at making some small changes to help live life more frugally.

First things first, stretch your food budget

This is where a lot of people are feeling the pinch like never before, but with a few small changes that will work for you and your lifestyle, you can help reduce the pain. You can do these on any budget, on any diet, and with as little time as you can find in your busy lifestyle.

Cooking, and even growing, your own food at home can help you stretch your budget a lot further.

Even a few herbs on the window sill can help to cut back costs and improve the taste of your home cooking.

Top Food Tips:

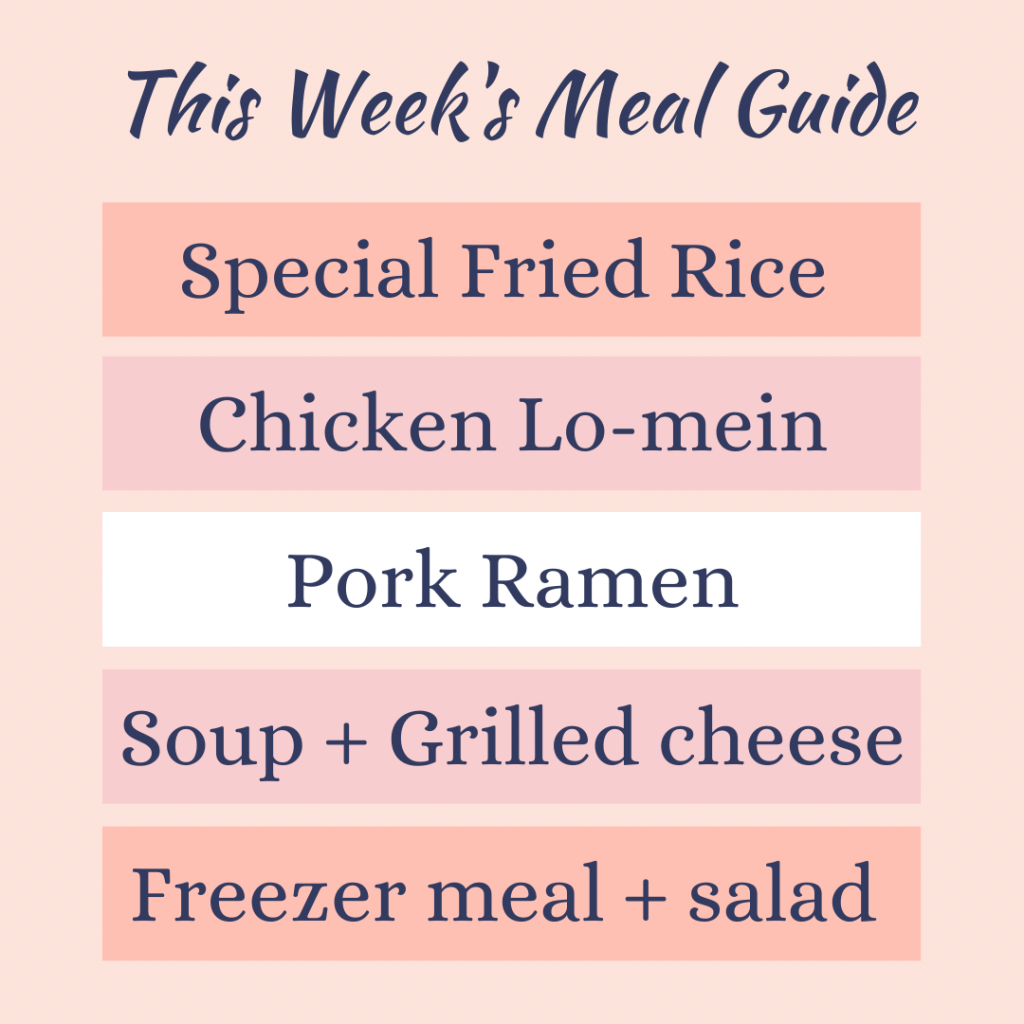

- Plan your meals in advance. This doesn’t have to mean a detailed meal plan for every meal every week but even having a rough idea of the things you are going to cook this week will make a huge difference.

- Shop the pantry first, a hugely important way to cut your grocery bill is to stop wasting food, making sure things don’t just get pushed to the back of the cupboard and never get seen again. Have you thought of a Pantry Challenge?

- The same goes for making sure those veggies in the bottom of the veggie draw get eaten and not thrown out. Storing them well so that they last the longest will help but also eating your fresh produce as soon as possible is important. Fresh first and frozen and canned second.

- Think about growing your own herbs and vegetables in the backyard or on the window sill. Even just some chives in a pot on the sill mean you aren’t buying them every week.

Opt for second or less expensive cuts of meat when shopping or buy your meat in bulk and use up every bit. Tougher cuts or offcuts are perfect for curries and stews and feed a lot of people for very little. Shop the specials, if it’s not on special this week it’s not in your trolley. Shopping at independent butchers can also drastically reduce your food costs.

- Make some of your own staples, cooking broths and stocks are super easy and so cheap to make. Some things you can try making, are pasta sauce, cheese sauce, soups, broths, stocks, yogurts, or shred your own cheese. The savings add up fast. It tastes better and it is better for you.

- Try the store brand products, We buy probably 30% store brand items and if you like them you’ll have made ongoing savings.

Optimize your shopping, making every dollar you spend work for you.

Make sure to use shopping loyalty programs like Flybuys and Woolworths rewards and always check Cashback Apps to see if you can get it via there. 3-5% back doesn’t seem like much but it adds up to hundreds of dollars a year you could have back into your family budget.

Frugal shopping tips

- Hit up your local thrift stores, garage sales, and other second-hand places when buying or replacing items.

- Stock up on nonperishable items when they’re on sale and keep a stockpile on hand, things like cleaners and household items are a great place to start.

- Know where to spend for quality rather than quantity. I personally will pay to buy quality white goods and vehicles but I’m happy to buy cheap vacuums and refurbish second-hand furniture or even build our own.

Find savings on household expenses

- Compare your bills and expenses regularly and see if you can get better value for your money. I do this roughly every 6 months. Don’t forget to check out pay-on-time discounts and loyalty programs for your bills.

Frugal home tips

- Before you throw something away see if you can’t fix or repurpose it into something else or even sell it secondhand on Facebook marketplace. A slap of paint and some new hardware can completely transform a piece of furniture.

- Watch YouTube videos for how to fix, do up and repurpose things.

Remember this is a marathon, not a sprint so look at making small changes and setting new habits as you go, have a look and see where you are in 6 months to a year, small changes can lead to huge savings.

And remember it is important to set these savings aside in a separate account as you make them and not to let them just get absorbed back into your budget and eaten away by something else.

Where are you going to start?

Leave a Reply