3 Steps to Building My Emergency Fund

This is not financial advice, I am just documenting my journey to financial freedom. Consider your own circumstances.

How I Plan to Save My Emergency Fund in 3 Clear Steps

Life is full of surprises. Whether it’s an unexpected medical expense, a job loss, or a sudden car repair, emergencies can happen at any time. That’s why having an emergency fund is one of the most important steps you can take to protect your financial well-being. It’s your financial safety net that helps you navigate life’s bumps without derailing your budget or going into debt.

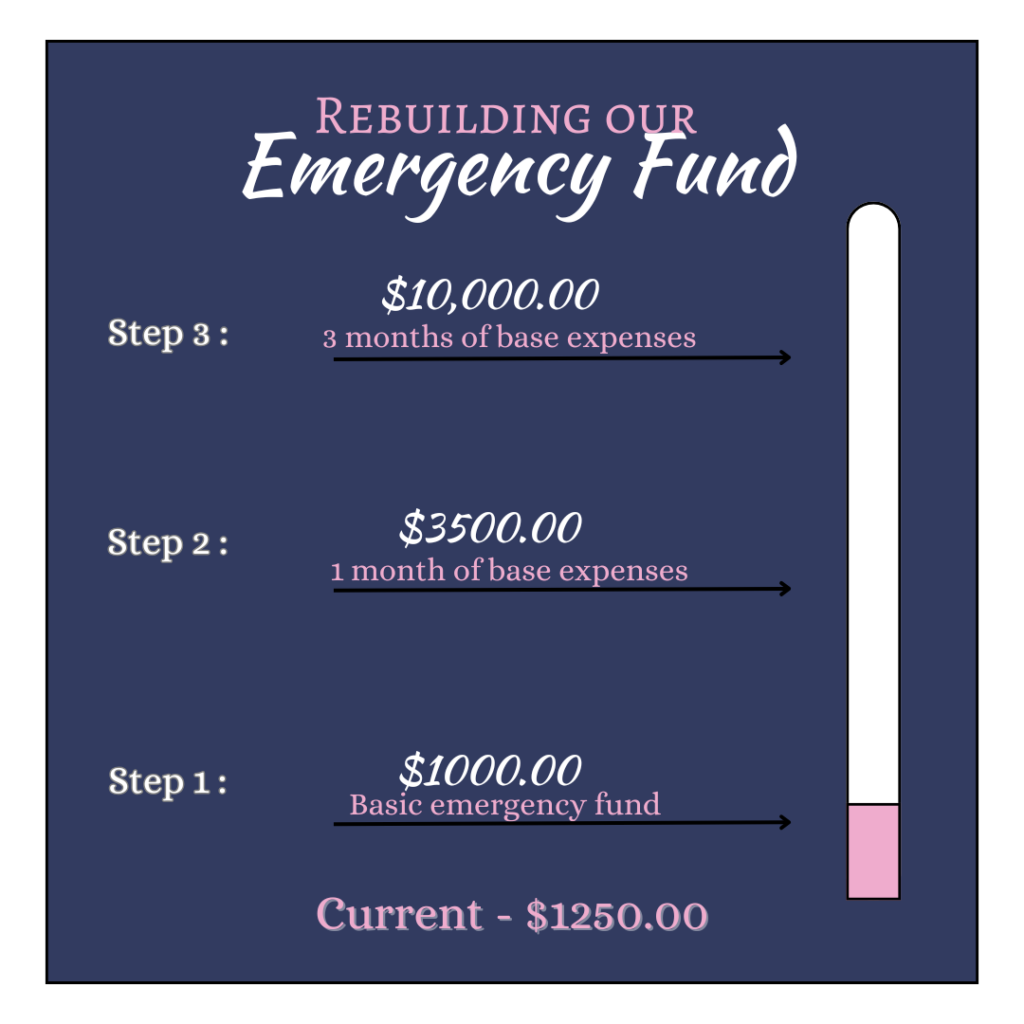

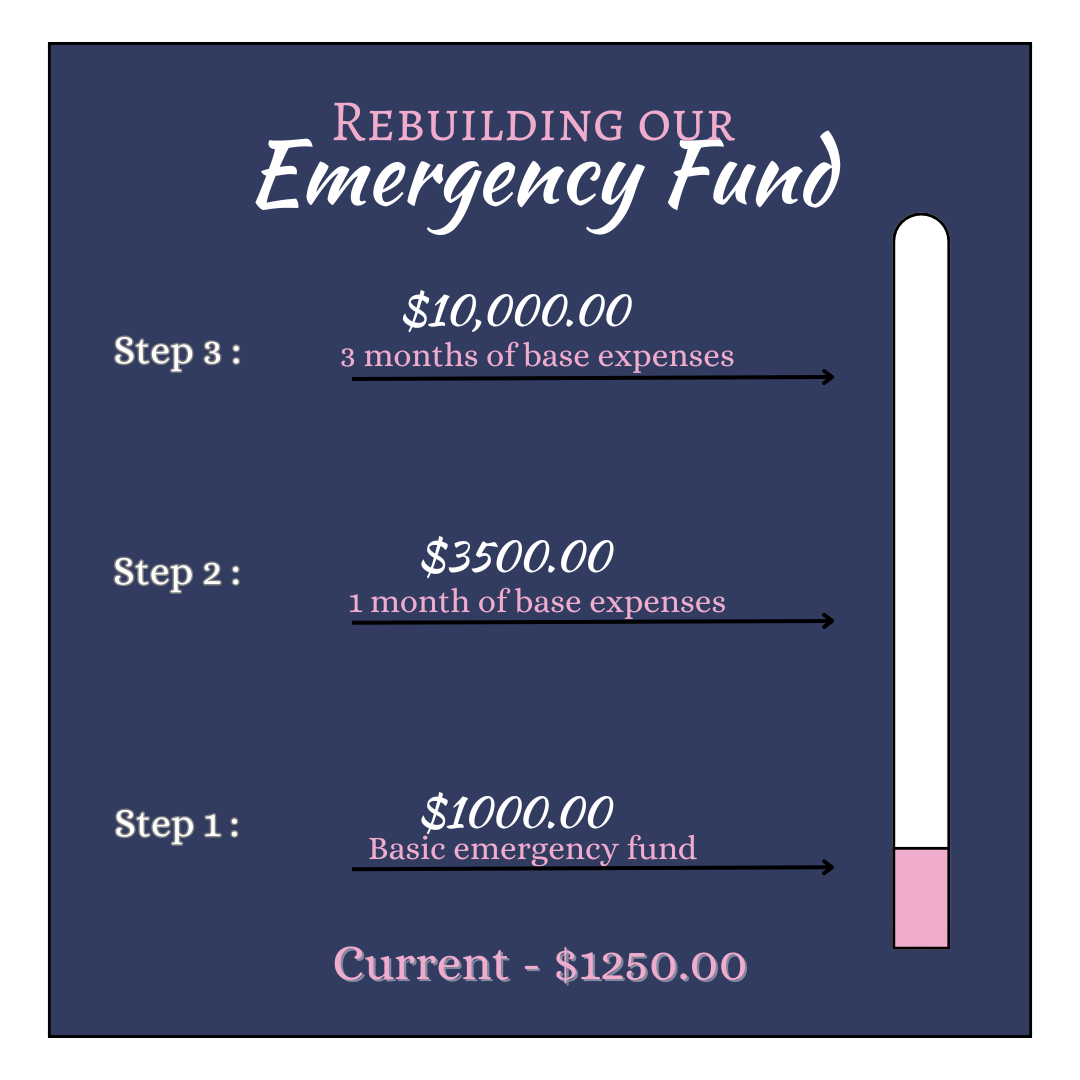

For my family, the next step is (re)building an emergency fund, I’ve broken down my plan into three manageable steps because that is what makes sense to my brain. Here’s how I plan to save for my emergency fund and why it’s so important to have one.

Why an Emergency Fund is Essential

Before diving into the specifics of my plan, it’s important to understand why an emergency fund is so important. An emergency fund provides peace of mind by ensuring you have the money you need when everything goes wrong. Without an emergency fund, you might find yourself relying on credit cards, loans, or other high-interest options to cover emergencies.

Having an emergency fund gives you flexibility and reduces anxiety. It also helps protect your family from situations where you might not have an income for a while, or when large, unexpected expenses pop up.

Step 1: Build a Basic Emergency Fund – $1,000

The first step in my emergency fund plan is to set aside $1,000 for the most immediate needs. While $1,000 may not cover all emergencies, it will provide a basic cushion to help with smaller, unexpected costs such as car repairs, medical co-pays, or home maintenance issues.

Why $1,000? You might have picked up that I like nice round whole numbers, haha. This amount is a manageable and achievable goal and can be built relatively quickly by making small sacrifices, cutting back on discretionary spending, or selling unused items around the house. It’s a great starting point to give me some breathing room.

Once I reach this $1,000 milestone, I’ll feel more secure knowing that I have some money set aside for emergencies without needing to go into debt. It’s the foundation upon which I’ll build the next two phases of my emergency fund.

Step 2: Save $3,500 = One Month of Basic Living Expenses

Once I have my $1,000 emergency fund in place, the next step is to save enough to cover one month of basic living expenses for my family. For us, this amounts to approximately $3,500, again rounded down to make it a whole number. This will cover our core expenses like rent, utilities, insurance, and transportation for one full month, giving us a more substantial financial cushion. Obviously, we won’t be living in luxury during an emergency so this is just the basics. No subscriptions, minimal food expenses, and other expenses.

Why one month of expenses? While $3,500 might not be a huge amount, it’s a key milestone because it ensures that we can weather any disruptions in our income for at least a month. For instance, if one of us loses a job or is injured and can’t work, we’ll have enough to pay for essential expenses without scrambling or relying on credit cards. With three kids this is a must for me.

Reaching this milestone will also help me feel more confident in my ability to handle day-to-day emergencies or disruptions without feeling overwhelmed. It’s an essential step in ensuring that our family’s financial foundation is stable enough to withstand a variety of unforeseen situations.

Step 3: Build a Full Emergency Fund of $10,000 (Three Months of Expenses)

Why $10,000? For our family, this amount strikes a balance between providing real security and remaining achievable over time. It may take a few months or even a couple of years to reach this target, but having that safety net in place will provide the ultimate peace of mind.

Honestly, I can’t foresee any emergency that would possibly need more than $10,000 to get us through, especially once we are out of debt completely (again) and have fully funded sinking funds. Both of these are goals in future financial our plan. $10,000 is a nice number that will keep me motivated to keep pushing and sacrificing to reach.

The final step in my emergency fund plan is to build a full emergency fund of approximately $10,000, which is three months of basic living expenses for my family of five. This will allow us to fully cover our living expenses for a longer period, giving us maximum financial flexibility during any challenging time.

Three months of expenses is the gold standard for an emergency fund because it provides ample protection against larger financial setbacks, like a long-term job loss or significant health issues. With this amount, I’ll be able to cover rent, utilities, food, and other essentials without worrying about how to pay for them if an emergency arises.

How I Plan to Reach These Goals

I have set up a High-yield savings account with Ubank, receiving 5.5% interest monthly when I deposit at least $500 monthly. if that is more than I can save in a single month, I can transfer money in and right back out again and it counts 😉 Each payday i will try and send something to savings, no matter if it’s $5 or $100. The goal is to be consistent, and even small, steady contributions will add up over time.

I’ll also be hustling to make extra payments to our savings. DoorDashing, Surveys, content creation and more.

Final Thoughts

Building an emergency fund is a journey, but it’s one that’s well worth the effort. By following these steps—starting with a basic $1,000 emergency fund, then saving enough for one month of living expenses, and finally building up to three months of expenses—I’ll have the financial cushion I need to handle unexpected challenges without derailing my family’s financial security.

If you’re considering starting your emergency fund, I encourage you to break it down into manageable steps and focus on consistency. The peace of mind that comes from knowing you’re financially prepared for life’s surprises is priceless. So, let’s take the first step today and build our financial safety net, one dollar at a time!

Emily,

@Aussiedebtfreegirl everywhere

Leave a Reply